Unpacking the Myth: Does Afterpay Affect Credit Score and Your Financial Future?

Unpacking the Myth: Does Afterpay Affect Credit Score and Your Financial Future?

Blog Article

Evaluating Whether Afterpay Use Can Influence Your Credit History

As the popularity of Afterpay proceeds to increase, many people are left asking yourself concerning the potential effect this solution might have on their credit score ratings. The correlation between Afterpay use and credit rating ratings is a topic of passion for those aiming to preserve or improve their economic health.

Understanding Afterpay's Influence on Credit report

The use of Afterpay can influence individuals' credit score ratings, prompting a demand for a thorough comprehension of its impact. Afterpay, a prominent "get now, pay later on" service, permits customers to split their acquisitions into smaller installment settlements. While Afterpay does not execute credit checks when consumers initially sign up, late or missed out on payments can still impact credit history scores. When a consumer misses out on a repayment, Afterpay might report this to credit history bureaus, leading to a negative mark on the person's credit scores report. It is necessary for customers to recognize that while Afterpay itself does not inherently harm credit scores, reckless use can have effects. Keeping an eye on payment due dates, maintaining a good repayment history, and making sure all installations are paid promptly are crucial actions in protecting one's debt score when utilizing Afterpay. By comprehending these nuances, individuals can utilize Afterpay sensibly while reducing any kind of possible unfavorable results on their credit rating ratings.

Elements That Impact Credit Report Rating Modifications

Comprehending Afterpay's impact on credit history scores reveals a straight link to the various aspects that can considerably affect modifications in a person's credit scores score over time. Using Afterpay properly without maxing out the readily available credit can assist keep a healthy credit rating use ratio. In addition, brand-new credit history questions and the mix of credit history accounts can affect credit history ratings.

Monitoring Credit Rating Changes With Afterpay

Checking credit rating modifications with Afterpay entails tracking the influence of payment practices and debt utilization on overall credit score wellness. By utilizing Afterpay sensibly, individuals can maintain or improve their credit history. Prompt settlements are crucial, as missed or late payments can negatively affect credit report ratings. Keeping an eye on settlement due days and guaranteeing sufficient funds are available to cover Afterpay installments can assist avoid any type of unfavorable effect on credit rating. Furthermore, keeping debt application reduced is necessary. Utilizing Afterpay for little, workable purchases and maintaining bank card equilibriums reduced family member to credit line demonstrates liable debt actions and can positively influence credit ratings. Consistently assessing debt records to check for any kind of mistakes or inconsistencies connected to Afterpay deals is likewise recommended. By remaining positive and watchful in monitoring repayment habits and credit use, individuals can effectively handle their credit rating rating while using Afterpay as a repayment option.

Tips to Handle Afterpay Sensibly

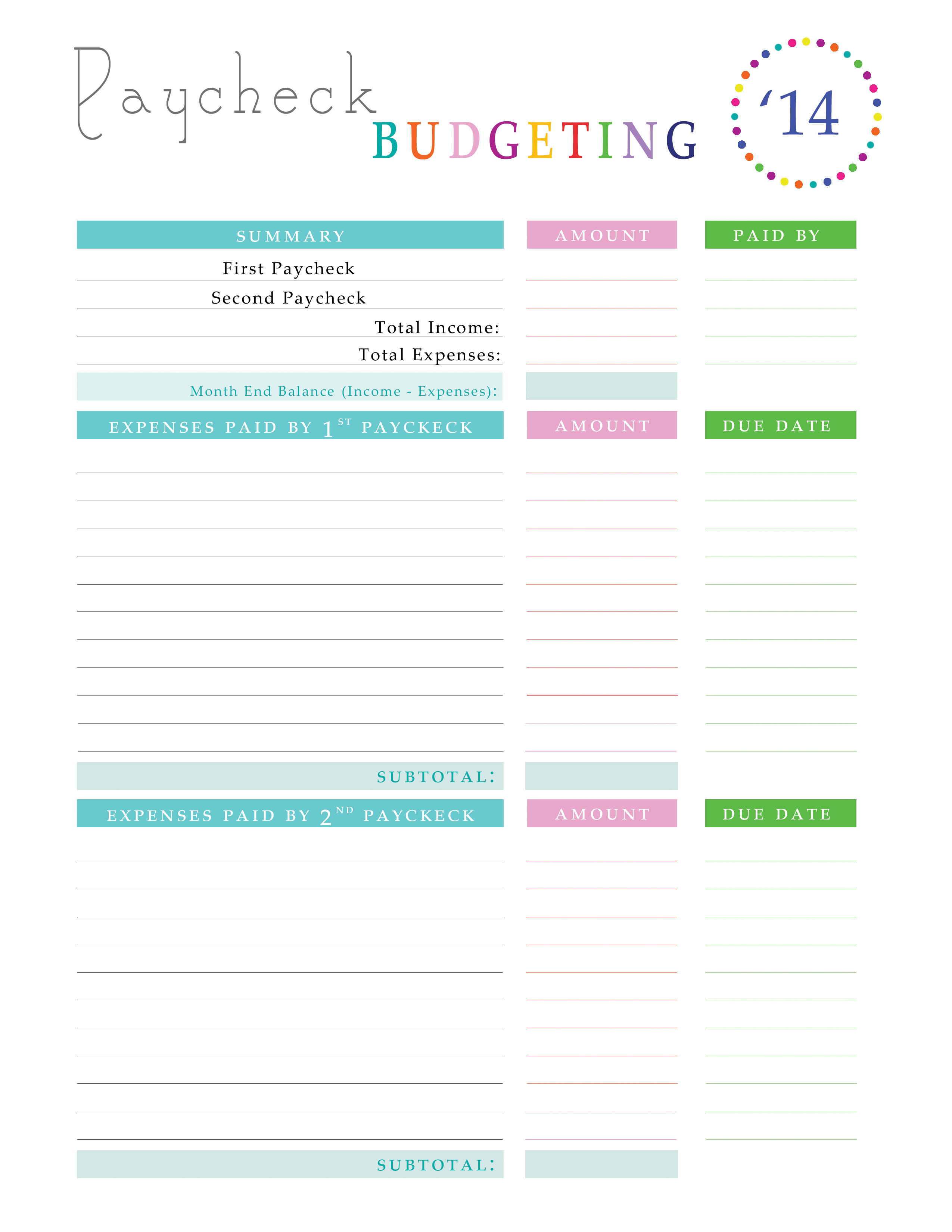

To browse Afterpay sensibly and keep a healthy and balanced credit rating, individuals can execute efficient techniques to handle their economic commitments intelligently. To start with, it is vital to develop a budget plan describing earnings and expenses to ensure price prior to dedicating to Afterpay purchases. This technique aids stop overspending and building up debt over one's head's methods. Secondly, using Afterpay uniquely for necessary items rather than indulgent acquisitions can aid in keeping economic security. Prioritizing payments for needs can protect against unneeded financial pressure and promote responsible investing practices. Additionally, monitoring Afterpay repayment timetables and making sure prompt repayments can help stay clear of late charges and adverse influence on credit score scores. Regularly checking Afterpay deals and total economic health and wellness through budgeting apps or spread sheets can offer beneficial insights right into spending patterns and aid in making enlightened financial choices. By following these ideas, people can leverage Afterpay sensibly while safeguarding their credit rating and monetary health.

Conclusion: Afterpay's Function in Debt Health

In evaluating Afterpay's influence on debt wellness, it her explanation becomes evident that prudent financial management remains critical for individuals utilizing this service. While Afterpay itself does not directly affect credit history scores, ignoring repayments can cause late charges and financial obligation build-up, which could indirectly impact creditworthiness - does afterpay affect credit score. It is essential for Afterpay users to budget properly and ensure timely settlements to promote a favorable credit score standing

In addition, comprehending exactly how Afterpay integrates with individual money practices is important. By utilizing Afterpay responsibly, individuals can appreciate the comfort of staggered repayments without jeopardizing their credit rating wellness. Checking costs, evaluating price, and remaining within why not look here budget are essential practices to avoid financial stress and potential credit report implications.

Verdict

Recognizing Afterpay's impact on credit report ratings discloses a straight web link to the various factors that can significantly affect modifications in an individual's credit history score over time. In addition, new debt inquiries and the mix of credit scores accounts can influence credit report scores.Keeping an eye on credit report rating changes with Afterpay entails tracking the influence of repayment habits and credit score usage on weblink general credit score wellness - does afterpay affect credit score. Utilizing Afterpay for tiny, workable acquisitions and maintaining debt card equilibriums low relative to credit scores limits shows accountable credit report habits and can positively affect credit score scores. By remaining proactive and cautious in checking repayment habits and credit application, individuals can effectively handle their credit scores rating while utilizing Afterpay as a repayment option

Report this page